Get the free pa600 printable

Show details

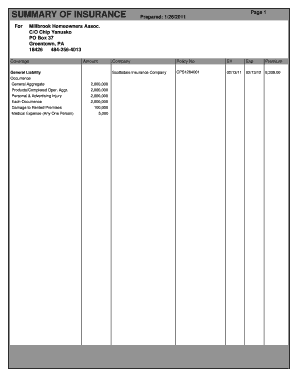

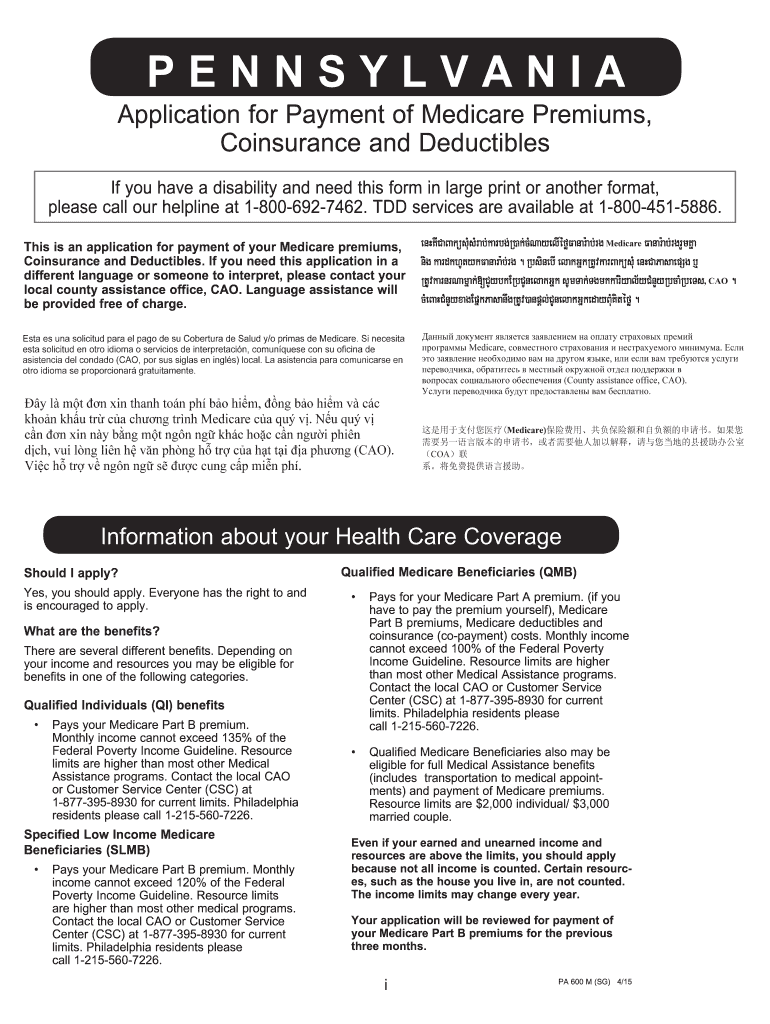

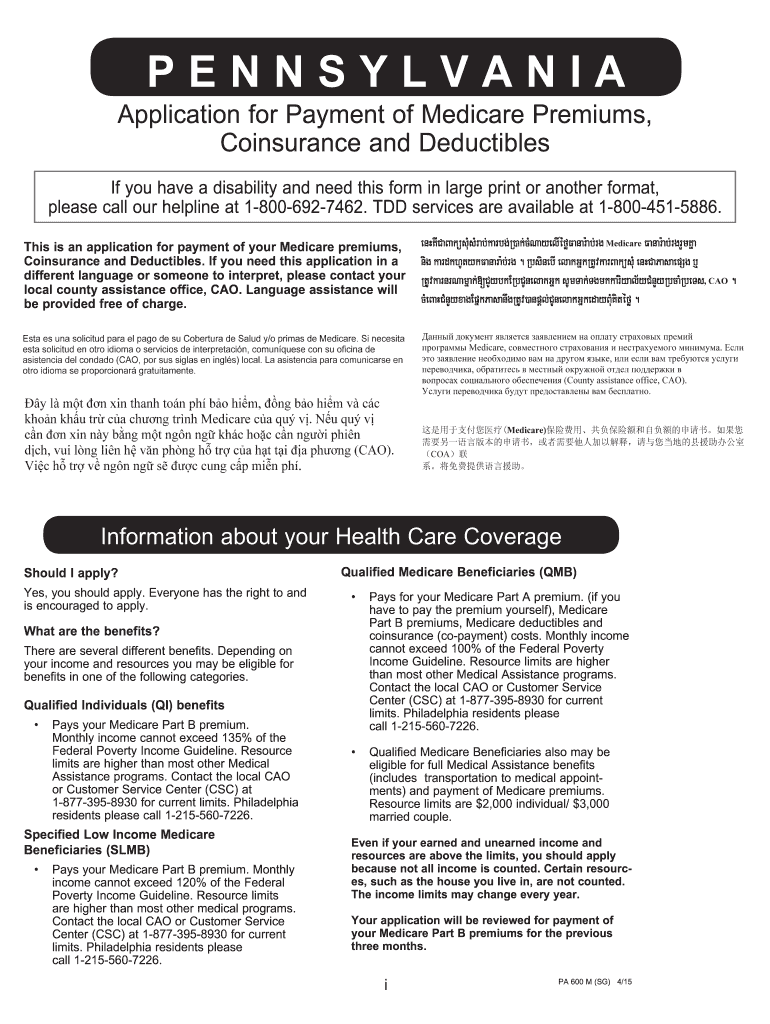

PENNSYLVANIA Application for Payment of Medicare Premiums, Coinsurance and Deductibles If you have a disability and need this form in large print or another format, please call our helpline at 1-800-692-7462.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pa600 printable

Edit your pa600 printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa600 printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pa600 printable online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pa600 printable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pa600 printable

How to fill out pa600 printable:

01

Gather all the necessary information and documents required for the form, such as personal details, employment information, financial statements, and any supporting documents needed.

02

Read the instructions and guidelines provided with the pa600 printable form carefully to understand the requirements and procedures for filling it out correctly.

03

Start by entering your personal information, including your full name, address, contact details, and social security number, in the designated fields on the form.

04

Provide accurate and up-to-date information regarding your employment history, including details about your current and previous employers, job titles, dates of employment, and income earned.

05

If applicable, provide information about your spouse or dependents, such as their names, social security numbers, and any relevant details requested on the form.

06

Fill in the financial section of the form, which may include information about your assets, liabilities, income, expenses, and any other financial details deemed necessary.

07

Review the completed form for any errors or missing information and make sure all sections are properly filled in before submitting it.

08

Make copies of the filled-out pa600 printable form for your records before sending it to the appropriate recipient or authority.

Who needs pa600 printable?

01

Individuals who are applying for certain government benefits or programs may need to fill out the pa600 printable form.

02

Businesses or employers who need to provide information about their employees for taxation or legal purposes may also require the pa600 printable form.

03

Any individual or organization that is legally required to report or disclose specific information to a government agency or entity may need to use the pa600 printable form.

Fill

form

: Try Risk Free

People Also Ask about

What is the highest income to qualify for SNAP?

Your net income is your gross income minus any allowable deductions. And assets are "countable resources" like cash, money in a bank account, and certain vehicles. For fiscal year 2023 (Oct. 1, 2022 – Sept. 30, 2023), a two-member household with a net monthly income of $1,526 (100% of poverty) might qualify for SNAP.

Can you work and get food stamps in PA?

You can get food stamps if your income is low, no matter what kind of income you have. Income includes wages, welfare, SSI, social security, child support, unemployment compensation, rental income, etc. Many people who have jobs can still get food stamps if their wages are low or if they support large families.

What documents do I need for PA SNAP benefits?

pay stubs for the last 30 days, unemployment letter, court order [or letter from Family Court] verifying amount of child support, income tax return for self-employed persons only, social security, disability, pension). Proof of child care expenses.

How much can you make to get food stamps in PA?

The best way to determine if and how much your household will qualify for SNAP is to apply.Income requirements beginning October 1, 2022: Household SizeMaximum Gross Monthly Income1$2,2662$3,0523$3,8404$4,6267 more rows

What is a PA 600 form?

Application for Medical Assistance for Workers with Disabilities - PA 600WD. Medical Assistance (Medical Assistance) Financial Eligibility Application for Long-Term Care Supports and Services - PA 600L.

How long does it take to get approved for SNAP in PA?

We will tell you within 30 days if you are eligible or not. If you need help with this application, please call your local county assistance office or call the helpline at 1-800-692-7462. have the right to expedited SNAP benefits. This means you can get SNAP benefits within five calendar days of the date you apply.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pa600 printable?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific pa600 printable and other forms. Find the template you need and change it using powerful tools.

How do I make edits in pa600 printable without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing pa600 printable and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the pa600 printable electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your pa600 printable in minutes.

What is pa600 printable?

Pa600 printable is a form used for filing personal income tax returns.

Who is required to file pa600 printable?

Any individual who earned income during the tax year is required to file pa600 printable.

How to fill out pa600 printable?

To fill out pa600 printable, you need to provide information about your income, deductions, and credits. You can either fill it out manually or use online tax filing software.

What is the purpose of pa600 printable?

The purpose of pa600 printable is to report your taxable income and calculate the amount of tax you owe or the refund you are entitled to.

What information must be reported on pa600 printable?

On pa600 printable, you must report your income from various sources such as wages, self-employment, investments, and rental properties. You also need to report your deductions, credits, and any taxes paid.

Fill out your pa600 printable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

pa600 Printable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.